do you have to pay inheritance tax in kansas

The state sales tax rate is 65. However if the beneficiarys net inheritance tax liability exceeds 5000 and the return is filed timely an election can be made to pay the tax in 10 equal annual installments.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

The percentage can range from 0 to 18 and there may be different rates for different types of property.

. Income Tax Range. The amount of inheritance tax that you will have to pay depends on. Here are some tax rates and exemptions that you should be aware of.

Residents of Kansas and Missouri will be happy to hear that your states are not included in the six. You may also need to file. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

The size of the inheritance. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. Hi Does Kansas have an inheritance taxwould it apply to someone living in Arizona.

Is there an amount you can receive before the. The state in which you reside. If person living in Arizona had taxes prepared in Kansas because of income received from Kansas.

This tax is based on the value of the assets received from the deceased and the heirs degree of relationship to the deceased. Like most states Kansas has a progressive income tax. Inheritance tax is strictly a state-mandated process there is no taxation from the federal government on individual inherited items.

The exemptions are large so many estates will owe no tax. Your relationship with the deceased. Surviving spouses are always exempt.

You should consult a lawyer. The estate tax is not to be confused with the inheritance tax which is a different tax. Up to 15 cash back In Kansas do you have to pay inheritance tax on money received through a person that does not have a will but goes through probate.

If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. Would the inheritance tax be imposed on all other income not matter where it came from when inherited because of the location of the tax prep. Currently there are only six states in the United States that assess the tax.

Talking about less than the big figure of l00000 where you always read federal tax is non-existent for the big amount of inheritance. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. The flip side is if you live in Kentucky and your uncle lived in California at the time of his death. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

State inheritance tax rates range from 1 up to 16. The tax due should be paid when the return is filed. You would owe Kentucky a tax on your inheritance because Kentucky is one of the six states that collect a state inheritance tax.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Kansas does not collect an estate tax or an inheritance tax. Kansas Inheritance Tax Kansas eliminated its state inheritance tax in 1998 and has not reinstated an.

Generally the tax is a percentage of the value of the property being inherited. Ad Inheritance and Estate Planning. 31 on 2501 to 15000of taxable income for single filers and 5001 to 30000for joint filers.

If the inheritance tax is paid within nine months of date of decedents death a 5 percent discount is allowed. If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. However if you are inheriting property from another state that state may have an estate tax that applies.

57 on more than 30000 of taxable income for single filers and more than 60000 for joint filers. Inheritance tax is strictly a state-mandated process there is no taxation from the federal government on individual inherited items. Kansas also has an intangibles tax levied on unearned income by some localities.

Kansas Probate Access Your Kansas Inheritance Immediately

Expanded Tax Breaks For Kansas Seniors Will Harm Low Income Seniors And Other Kansans Kansas Action For Children

Sell House Before Property Tax Foreclosure Kansas Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Mineral Rights Taxes Tax Implications Of Selling Mineral Rights

Kansas Probate Access Your Kansas Inheritance Immediately

Expanded Tax Breaks For Kansas Seniors Will Harm Low Income Seniors And Other Kansans Kansas Action For Children

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Kansas Elder Law Attorneys Other Professionals Law Firm

American Tax Service A Professional Tax And Accounting Firm In Topeka Kansas Life Events

Kansas Probate Access Your Kansas Inheritance Immediately

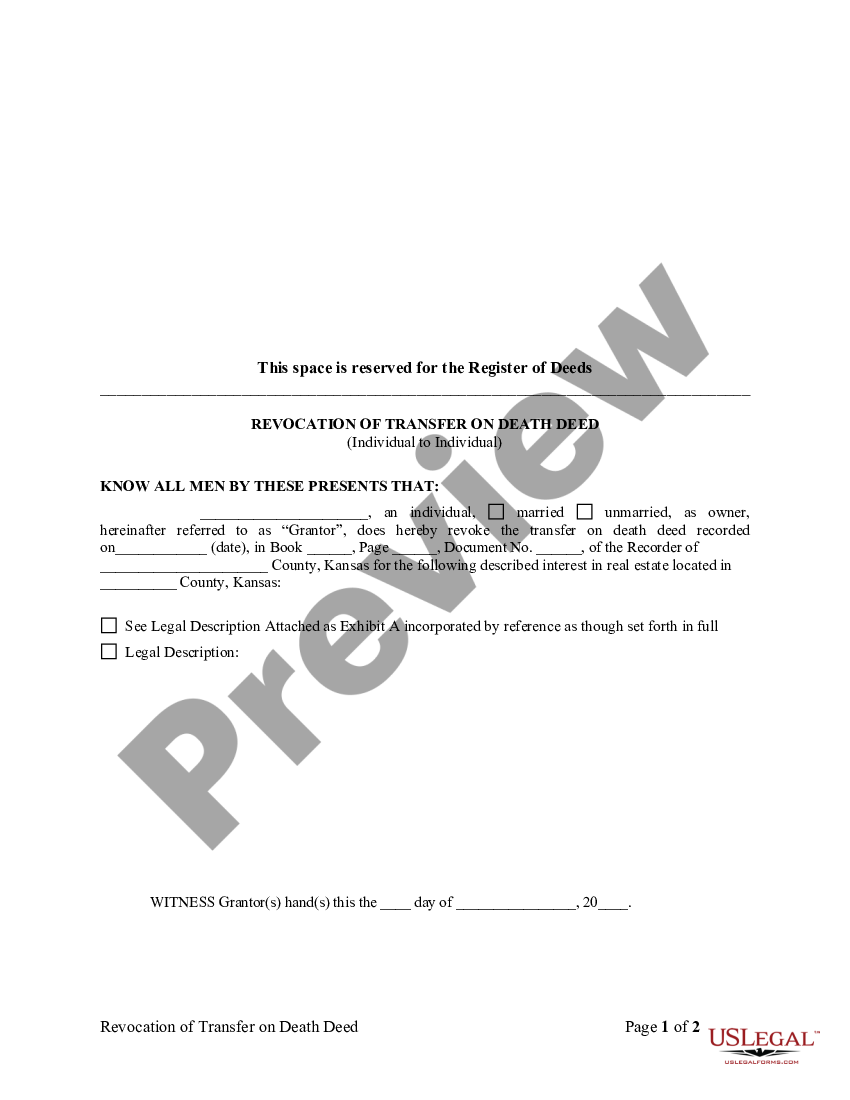

Kansas Revocation Of Transfer On Death Deed Transfer Death Deed Us Legal Forms